Click Here for Credit Counselling Services with EDUdebt in Singapore

Click Here for Credit Counselling Services with EDUdebt in Singapore

Blog Article

Exploring Credit Rating Counselling Services: What You Required to Know for Successful Debt Management

Credit counselling solutions have actually arised as a viable service, providing skilled support tailored to specific scenarios. What crucial variables should one take into consideration before involving with a credit report counsellor to guarantee ideal results?

Recognizing Credit Scores Therapy Provider

Debt coaching solutions act as a crucial source for people dealing with financial obligation monitoring (click here). These solutions supply specialist support and assistance to aid customers navigate their economic difficulties. Commonly supplied by licensed credit history counsellors, these programs aim to enlighten individuals concerning their monetary situation, including their credit scores records, arrearages, and overall monetary health

Counsellors evaluate a client's financial standing through thorough evaluations, that include income, expenses, and financial debt levels. Based on this analysis, they develop customized strategies that may entail budgeting approaches, debt repayment options, and financial education. Credit scores counselling services frequently facilitate communication in between financial institutions and customers, helping to discuss a lot more beneficial settlement terms or negotiations.

These services can be particularly useful for those dealing with overwhelming financial obligation or considering insolvency, as they provide an alternate path to monetary recuperation. Furthermore, credit rating coaching can instill improved economic routines, equipping people to make enlightened decisions regarding their money in the future. It is vital for customers seeking these solutions to choose respectable companies, as the high quality and technique of credit therapy can differ dramatically amongst companies.

Advantages of Credit Coaching

Numerous people experience substantial relief and empowerment through debt counselling services, which provide numerous benefits that can transform their monetary overview. Among the primary benefits is the individualized monetary advice provided by certified credit report counsellors. These specialists assess a person's economic scenario and tailor a plan that deals with details financial debt difficulties, assisting clients gain back control over their funds.

Getting involved in credit scores coaching can boost one's credit rating over time, as clients demonstrate accountable financial habits. In general, the advantages of credit report therapy solutions expand past immediate debt relief, providing a comprehensive technique to achieving enduring financial wellness and health.

Just How Credit History Counselling Functions

Understanding the technicians of credit scores counselling is essential for people looking for efficient financial debt administration solutions. Credit rating counselling normally begins with a detailed assessment of a person's economic scenario - click here. Throughout this preliminary assessment, a qualified debt counsellor reviews earnings, expenses, and financial obligations to identify specific challenges

Following this evaluation, the debt counsellor develops a personalized activity plan tailored to the person's one-of-a-kind conditions. This plan frequently consists of budgeting approaches and suggestions for minimizing expenditures, along look at these guys with pointers for raising income preferably.

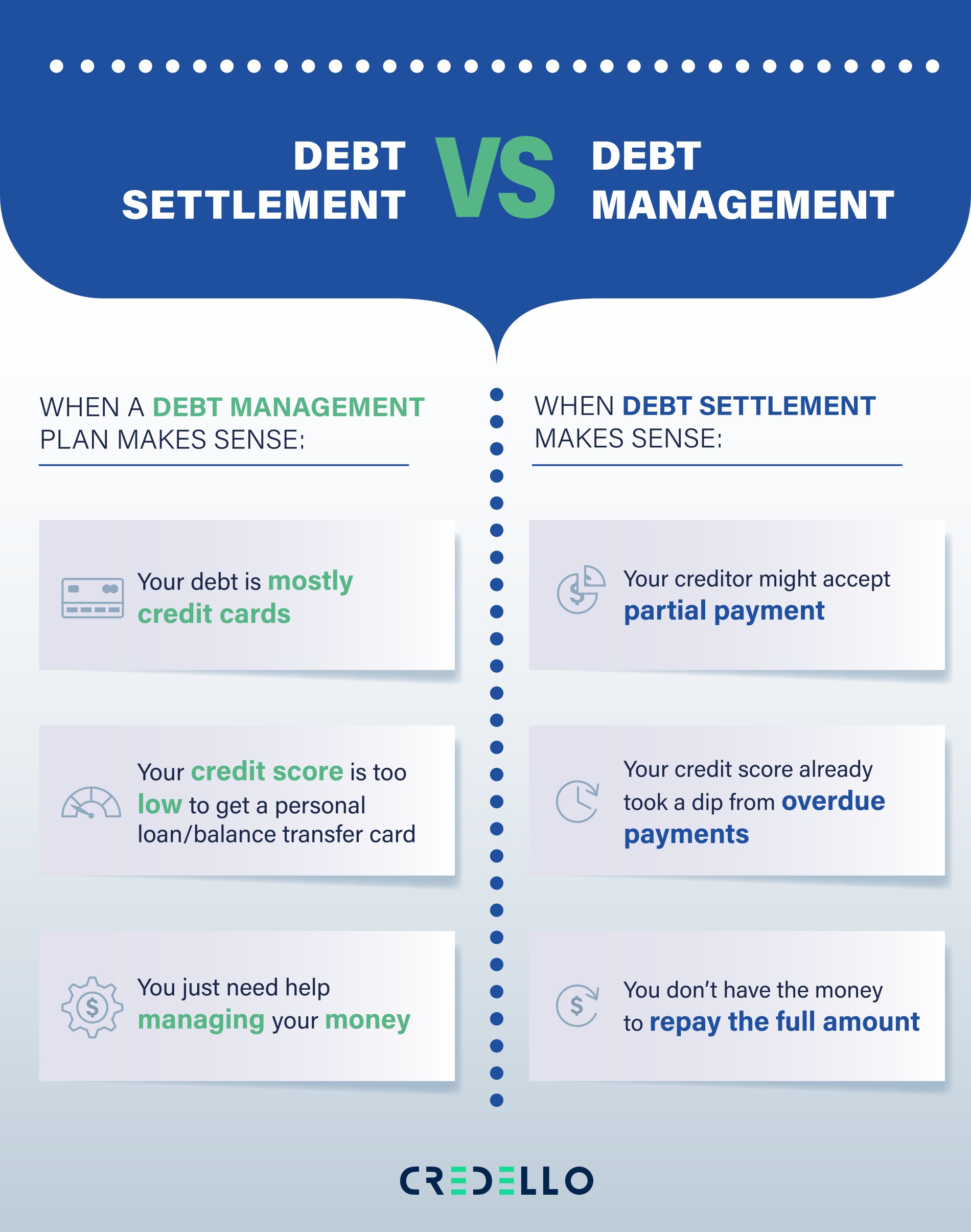

One trick aspect of credit rating counselling is the establishment of a financial debt management plan (DMP) If deemed suitable, the counsellor negotiates with creditors to protect more beneficial payment terms, such as lower rates of interest or extensive settlement periods. This can substantially alleviate economic pressure.

Throughout the procedure, credit rating counsellors offer ongoing support and education, encouraging individuals with the expertise and abilities required to accomplish long-lasting monetary security. Normal follow-ups make sure accountability and aid clients stay on track with their economic goals. Eventually, reliable credit go scores counselling not only addresses instant debt worries yet also cultivates lasting financial practices for the future.

Selecting the Right Credit Score Counsellor

When browsing the complicated landscape of financial debt administration, picking the ideal credit scores counsellor is important for accomplishing effective outcomes. The perfect credit counsellor should possess credentials and experience that validate their competence. Look for licensed professionals associated with reputable organizations, such as the National Structure for Credit Counseling (NFCC) or the Financial Counseling Organization of America (FCAA)

Furthermore, think about the counselling strategy they use. An extensive examination of your financial situation must come before any recommended solutions. This makes certain that the strategies provided are tailored to your details needs instead of common recommendations.

Openness is an additional essential element. A trustworthy counsellor will certainly offer clear information regarding charges, services used, and possible end results. Be cautious of counsellors that assure unrealistic results or use high-pressure sales methods.

In addition, gauge their communication style. A great credit report counsellor ought to be approachable, patient, and willing to address your questions. Developing a rapport is crucial for a productive working relationship.

Finally, look for recommendations or review online reviews to examine the counsellor's track record. By vigilantly assessing these variables, you can select a credit scores counsellor that will properly assist you in your journey toward monetary stability.

Tips for Effective Financial Debt Administration

Efficient financial obligation management calls for a calculated strategy that encompasses a number of essential techniques. Initially, producing an extensive spending plan is vital. This ought to detail your income, expenses, and debt responsibilities, allowing you to identify areas where you can reduce costs and allocate more funds in the direction of financial debt repayment.

Second, prioritize your financial debts by focusing on high-interest accounts first, while making minimal view payments on others. This method, referred to as the avalanche approach, can save you money in rate of interest over time. Additionally, the snowball method, which stresses paying off smaller financial obligations initially, can give mental inspiration.

Third, establish an emergency situation fund. Having actually cost savings reserved assists avoid brand-new financial obligation accumulation when unanticipated costs occur. Additionally, take into consideration negotiating with lenders for better terms or lower rate of interest, which can reduce your repayment worry.

Lastly, look for expert support from credit history counselling solutions if essential. These professionals can give tailored guidance and assistance for your distinct economic scenario, assisting you stay responsible and concentrated on your objectives. By implementing these strategies, you can effectively manage your debt and work towards achieving financial security.

Verdict

To conclude, debt therapy solutions play an important function in effective debt monitoring by providing customized advice and support. These services empower individuals to create customized activity strategies and work out favorable terms with financial institutions, ultimately causing improved monetary literacy and stability. Selecting the suitable credit history counsellor is necessary to take full advantage of advantages, and applying successful financial obligation management approaches fosters lasting financial health. Involving with credit report counselling can dramatically boost one's capacity to browse economic difficulties and achieve economic objectives.

Usually offered by qualified credit rating counsellors, these programs intend to educate individuals about their economic circumstance, including their credit records, impressive financial obligations, and total monetary wellness.

Taking part in debt therapy can boost one's credit score over time, as customers show accountable economic actions. In general, the benefits of credit therapy services expand past instant debt alleviation, supplying a thorough technique to attaining lasting economic health and wellness.

Eventually, effective credit history counselling not only addresses instant financial debt concerns however also fosters lasting economic practices for the future.

Report this page